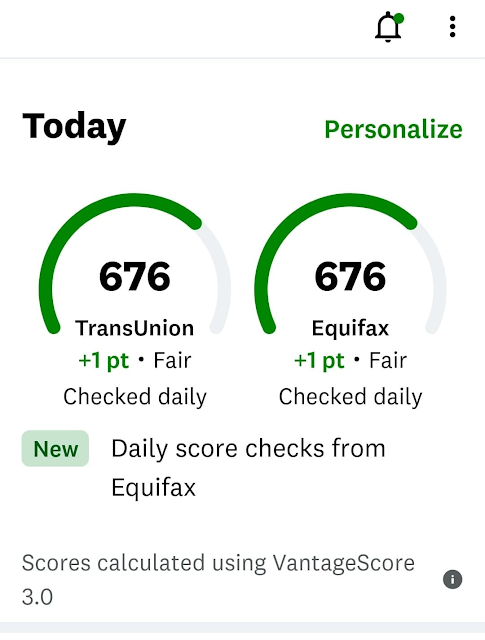

Raising Credit Scores Quickly

Years ago, I did a series on how to raise your credit scores quickly...you can find those posts here:

And there is some really great information to have in those posts. However, it's been almost 6 years since I wrote those and a lot of things have changed for me since then.

As many of you know, I left an abusive marriage with my six kids back in 2019.

Up until that point, everything had been in my ex-husband's name. I had absolutely NO credit whatsoever.

Seriously.

When Jeff and I started talking about buying a house, I signed up for a Credit Karma account and they couldn't even tell me a score because there was nothing!

Then Jeff gave me some huge life-changing (in terms of credit hahaha) advice:

We bank through Huntington (we each have our own account currently). On the Huntington app, there is a little thing called "Standby Cash". Which is basically a short-term small loan.

He told me that by getting a small loan through Standby Cash and paying it off in time, it will raise my credit score.

So I tried it a few months ago.

Literally a few months ago...I think it was just this past April.

I believe I took out $400-500.

I paid it back in the small recommended installments.

And look what happened to my credit just with that little loan:

Comments